Overview of the global steel market – May 2023

In April 2023, the world's crude steel production for 63 reporting countries to the World Steel Association (worldsteel) was 161.4 million tons, representing a 2.4% decrease compared to April 2022.

The downward trend in China's construction activities, which had slowed since April due to weaker-than-expected real estate sector, is expected to continue until June, putting pressure on steel prices in China.

China's construction steel production showed a decreasing trend in April, and end-user demand even declined more rapidly, leading to a significant decrease in steel prices.

Daily production of steel bars and coils in China decreased by 5.8% in April compared to the previous month, reaching 1.12 million tons, but it was still 1.2% higher than the same period last year.

In the context of weakened steel demand, domestic steel bar prices in China were evaluated to decrease by 588 NDT per ton ($83.70 per ton), equivalent to a 13.7% decrease, from the beginning of April to May 19.

Some sources do not expect China's construction steel demand to improve in May-June, not only due to the weaker real estate sector but also because China may focus on financial support for infrastructure projects in Q3 instead of Q2 to ensure stable annual economic growth.

China's economic growth was significantly impacted in Q2 2022 due to COVID-related lockdowns in major Chinese cities. Economic activities subsequently rebounded strongly in the following quarters, which will influence the year-on-year growth in Q3 2023.

Expectations for Q3 Recovery:

Steel demand and prices may rebound in August-September, driven by financial stimulus in the infrastructure sector and its spillover effect on manufacturing. However, the growth could be modest unless compulsory steel production cuts by the government are activated.

Coils:

The global market faces weakening demand:

In the US, the hot-rolled coil (HRC) market weakened in mid-May as prices decreased due to mills trying to boost order books amidst lackluster spot market activities.

US HRC price was evaluated at $1,050 per ton ex-works Indiana on May 19, a $40 per ton decrease from the previous evaluation.

In Europe, the HRC market sentiment was also not very positive. The domestic HRC price in Northwestern Europe decreased by 10 Euros per ton ($11) from the previous week to reach 760 Euros per ton ex-works Ruhr on May 19.

In Asia, HRC weakened in the week ending on May 19 due to slower demand from buyers in Southeast Asia.

The price of SS400 3mm thick HRC decreased by $21 per ton from the previous week to $549 per ton FOB China on May 19. The same type of coil was evaluated to increase by $6 per ton from the previous week to $550 per ton CFR Southeast Asia.

The spot price of Q235 5.5mm HRC in Shanghai was 3,890 NDT per ton ($558.58 per ton) on May 19, including VAT, an increase of 30 NDT per ton from the previous week.

Long Products:

The global market finds stability:

The export price for Turkish rebar was stable at $620.50 per ton FOB on May 19.

In the US, the price for Eastern US rebar ranged from $925 to $945 per ton on May 19, unchanged from the previous week.

In Asia, the rebar market remained stable despite a downward trend in long steel futures due to weaker raw materials and sluggish trading activities, while billet prices decreased.

The price of BS4449 500-grade 16-32mm rebar was stable at $565 per ton CFR Southeast Asia on May 19, and BS500B-grade 16-20mm rebar exported from China was priced at $560 per ton FOB China.

Plate:

In the US, the plate market remained stable as steel mills maintained prices and demand remained steady. The US plate price was $1,610 per ton on May 17, unchanged for the third consecutive week.

In Southern Europe, HRC prices decreased by 25 Euros per ton ($27) from the previous week to reach 820 Euros per ton ex-works Italy on May 19.

In Asia, the plate market faced weakness due to subdued downstream demand.

The price of SS400 12-20mm thick plate decreased by $5 per ton from the previous week to $620 per ton FOB China on May 17. The same type of plate with a thickness of 12-25mm was evaluated at $620 per ton CFR South Korea, decreasing by $15 per ton during the same period.

In the Chinese export market, mills offered plates at $600-$630 per ton FOB China, $10-$15 lower than the previous week.

Scrap:

Recovery in most markets:

The scrap market showed more strength in mid-May, with increases in India and Taiwan and higher demand in Turkey.

Imported shredded scrap price in India increased in the week ending May 19, reaching $437.50 per ton CFR Nhava Sheva, an increase of $7.50 per ton from the previous week.

The price for UK-origin HMS 1/2 scrap was $440 per ton CFR Nhava Sheva, and US-origin HMS 1/2 scrap was priced at $437-$438 per ton CFR Nhava Sheva, while bids were heard at $435 per ton CFR Nhava Sheva.

The premium heavy melting scrap 1/2 price in Turkey was $375.50 per ton CFR on May 19.

In Asia, the CFR Taiwan scrap price rebounded in the week ending May 19 due to fewer offers in the market, while market expectations across Asia increased, ending a month-long price decrease.

The 80:20 HMS 1/2 container scrap price CFR Taiwan increased by $8 per ton from the previous week to $364 per ton on May 19.

The transaction price for US-origin HMS 1/2 80:20 scrap in container remained stable at $355-$360 per ton CFR Taiwan in the week ending May 19, compared to $350-$355 per ton CFR the previous week.

Asian Steel Scrap Prices Increase:

Premium coking coal price CFR China increased as purchasing improved while premium coking coal price FOB Australia decreased slightly, with sidelined market participants.

In the CFR China market, the price continued to increase due to improved buying interest, especially for Australian coal with shorter delivery times compared to US/Canada coal.

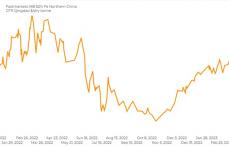

Asian Iron Ore Prices Decrease:

Asian iron ore prices decreased on May 18 due to weak Chinese steel demand, while trading activities remained stable.

The iron ore index 62% Fe was evaluated at $110.3 per dry ton CFR North China on May 18, a decrease of 70 cents per dry ton from the previous day.

Sluggish steel industry data, along with declining futures prices, put pressure on seaborne iron ore prices.

(Source: Sbb, May 2023)